Nasdaq Central Counterparty

Nasdaq Nordic Investor News NASDAQ OMX targets April 2012 timeline for competitive Central Counterparty clearing in the Nordics. Nasdaq Nordic offers trading of fixed income derivatives both on the exchange and as OTC.

The positions were closed out through an auction to other clearing members but losses on the portfolio exceed the defaulting members margin collateral and default fund contribution by 114 million over US 129.

Nasdaq central counterparty. Nasdaq Nordic serves as a central gateway to the Nordic and Baltic financial markets with over 700 listed companies on the main markets and the growth markets Nasdaq First North. The trader could not meet margin calls and was declared in default by Nasdaq Clearing who were acting as central counterparty to the trades. NASDAQNDAQ today announces its intention to introduce competitive Central Counterparty CCP clearing by end of April 2012 in cooperation with.

NASDAQ OMX Announces Timeline for Competitive Central Counterparty Clearing in Nordics Jun 12 2009 STOCKHOLM Sweden Jun 12 2009 GlobeNewswire via COMTEX News Network -- NASDAQ OMX Nordic. Central counterparty clearing support product of the year. Nasdaq Clearing AB Nasdaq Clearing is a leading EMIR-authorized CCP providing central counterparty clearing services for a broad range of markets and asset classes.

Central counterparties have been described as unlikely heroes for their handling of the Lehman Brothers default Norman 2011. Nasdaq Through the Nasdaq Financial Framework NFF for central counterparties CCP the Nasdaq combines multi-asset real-time clearing settlement and risk management technologies. Nasdaq Nordic supports competitive central counterparty model with interoperating CCPs which allows members the choice of a CCP from EuroCCP NV LCHClearnet Ltd and SIX x.

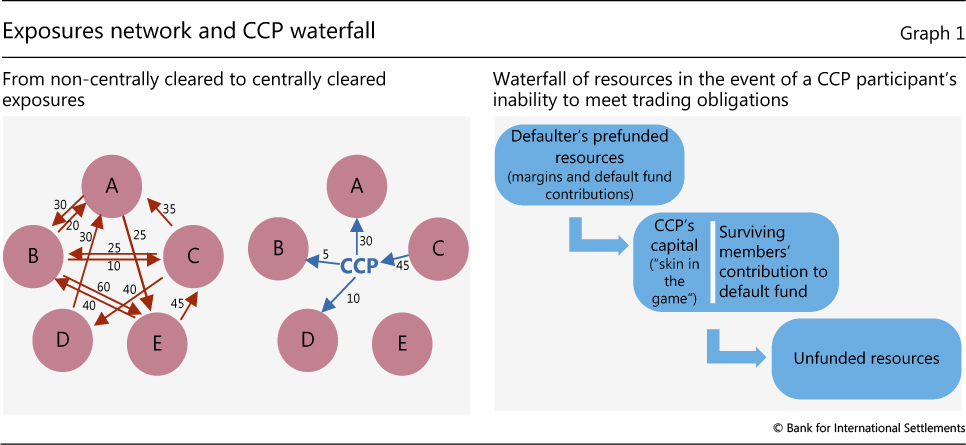

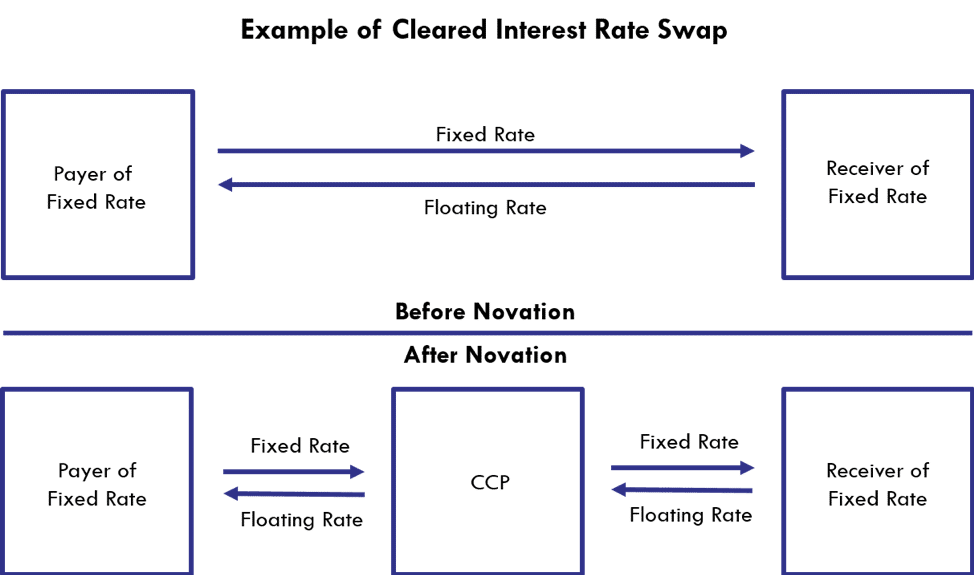

A central counterparty that went bad would no longer be able to fulfill its main duty. Central Counterparty Clearing House An organization in European countries that helps facilitate trading done in European derivatives and equities market. By introducing a central counterparty counterparty risk is redistributed from the two parties involved in the trade to a central counterparty participant -.

Lehman had derivative portfolios at a number of CCPs across the world and with one exception these were. 7 Nasdaq OMX learing As extension of the initial authorisation was renounced and withdrawn under Article 20 of EMIR on 3 March 2016 8 LCH Limited ceased being an authorized European Central Counterparty on Brexit day ie. Central counterparties have been described as unlikely heroes for their handling of the Lehman Brothers default Norman 2011.

We provide central counterparty CCP clearing services. 12 May 2020 London Stockholm Skytra the wholly owned subsidiary of Airbus has selected Nasdaq Clearing AB as the central counterparty CCP for the new derivatives trading platform that Skytra is developing to allow the global air travel industry to hedge revenue risk for the first time. Lehman had derivative portfolios at a number of CCPs across the world and with one exception these were.

Stockholm October 4 2011 NASDAQ OMX Nordic part of The NASDAQ OMX Group Inc. CCPs proved resilient during the crisis continuing to clear contracts even when bilateral markets dried up Domanski et al 2015. The introduction of central counterparty clearing in the Nordic equity markets is part of NASDAQ OMXs strategy to increase market liquidity by.

12 NASDAQ CLEARING Nasdaq Clearing operates central counterparty clearing for derivative instruments and offers clearing of equity and. Our offering includes clearing of both exchange traded and OTC derivatives contracts as well as a repo clearing service. Central Counterparty Clearing Support Product of the Year.

Through the Nasdaq Financial Framework NFF for central counterparties CCP s Nasdaq combines multi-asset and real-time clearing settlement and risk management technology. Skytra the wholly owned subsidiary of Airbus has selected Nasdaq Clearing AB as the central counterparty CCP for the new derivatives trading platform that Skytra is developing to allow the global air travel industry to hedge revenue risk for the first time. Making sure everyone is paid for every trade.

NFF enables CCP s to handle the full range of post-trade functions clearing settlement and depository. A bank dealing with one bankrupt clearinghouse could default on. The date on which the Treaties ceased to apply to and.

Skytra a wholly owned subsidiary of Airbus has selected Nasdaq Clearing AB as the central counterparty CCP for its new derivatives trading platform aimed at allowing the global air travel industry to hedge revenue risk for the first time. Nasdaq Clearing acts as central counterparty in respect of transactions entered into between two parties outside of Nasdaq Clearing in instruments which the CCP accepts for clearing. Nasdaq Clearing - Cleared Markets Central counterparty clearing for several markets including Equity derivatives Index Fixed Income and Commodities.

EUROPE As part of its majority stake acquisition in Easdaq the Brussels based pan-European stock exchange US exchange Nasdaq says it is planning to establish a user-controlled European central counter-party CCP shaking up talks of. CCPs proved resilient during the crisis continuing to clear contracts even when bilateral markets dried up Domanski et al 2015.

Default Fund And Clearing Capital Nasdaq

Understanding Central Counterparties Ccps Global Financial Markets Institute

Posting Komentar untuk "Nasdaq Central Counterparty"